Risk Intelligence for DeFi Lending Protocols

Custom dashboards, tooling, and expert consulting to guide risk decisions, parameters, and protocol growth.

Trusted by protocols securing over $17B in on-chain assets

What We Do

We help DeFi protocols manage risk and make better decisions.

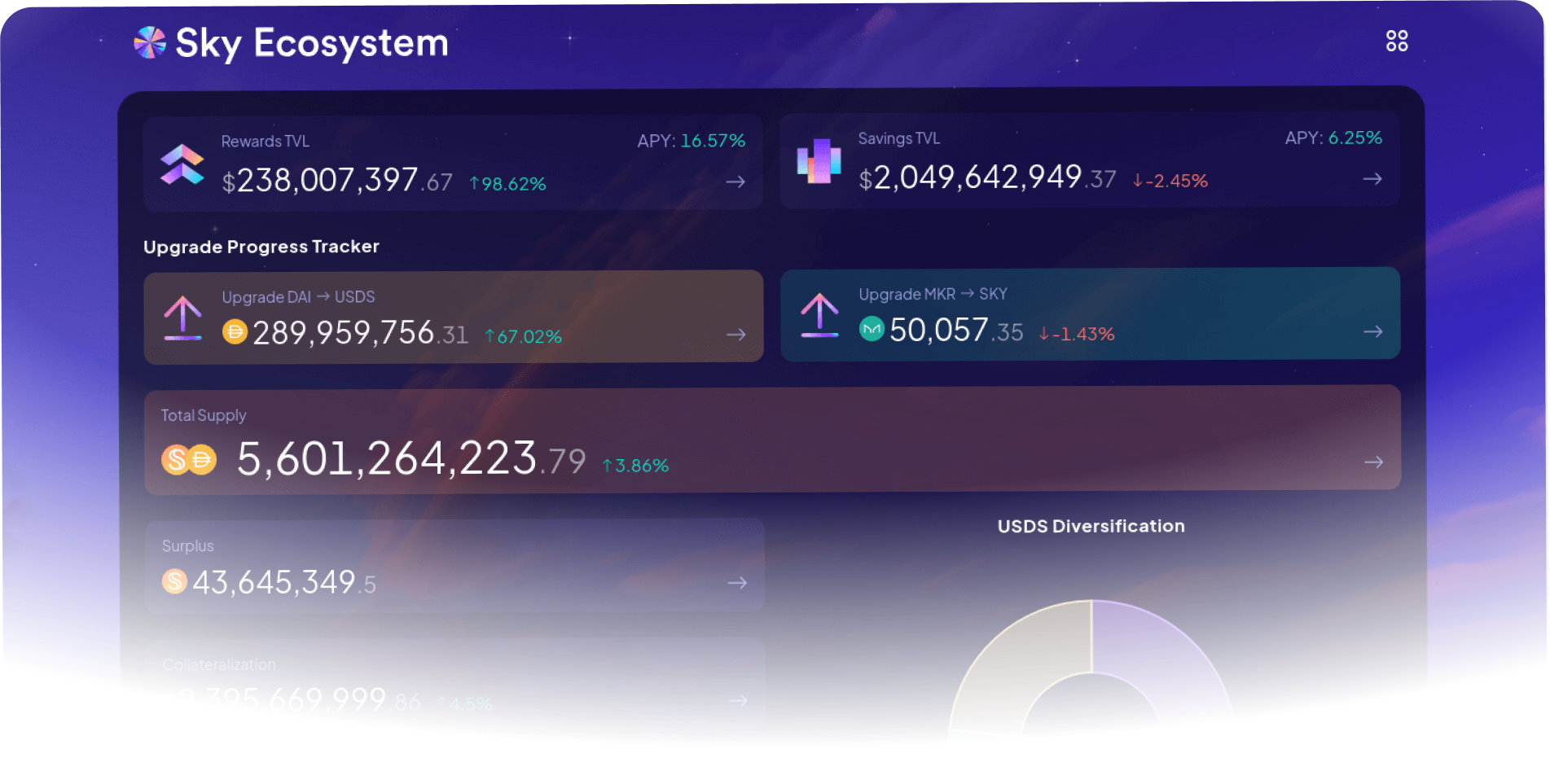

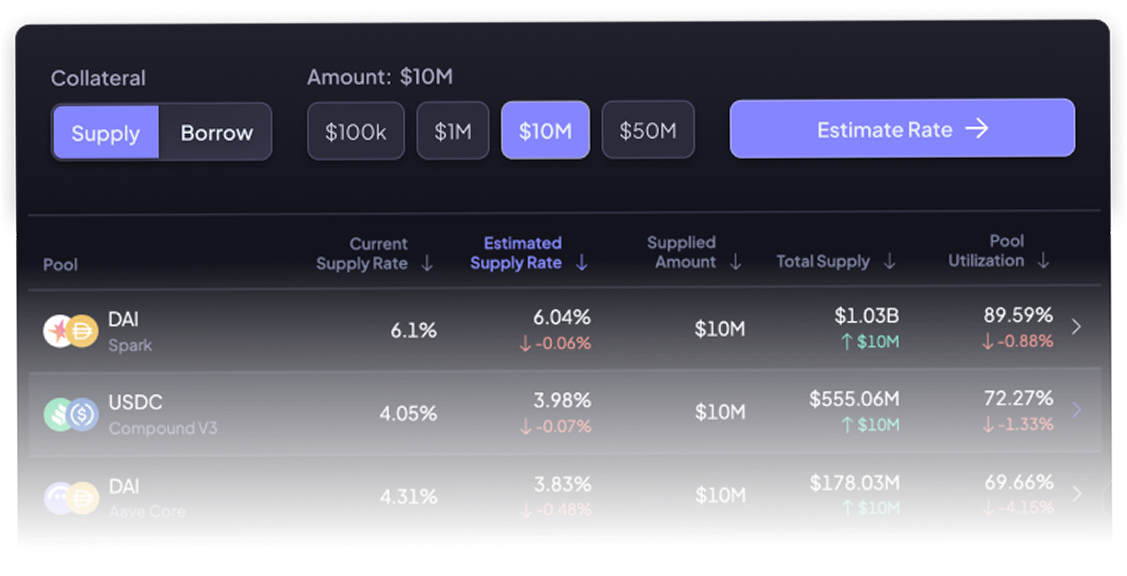

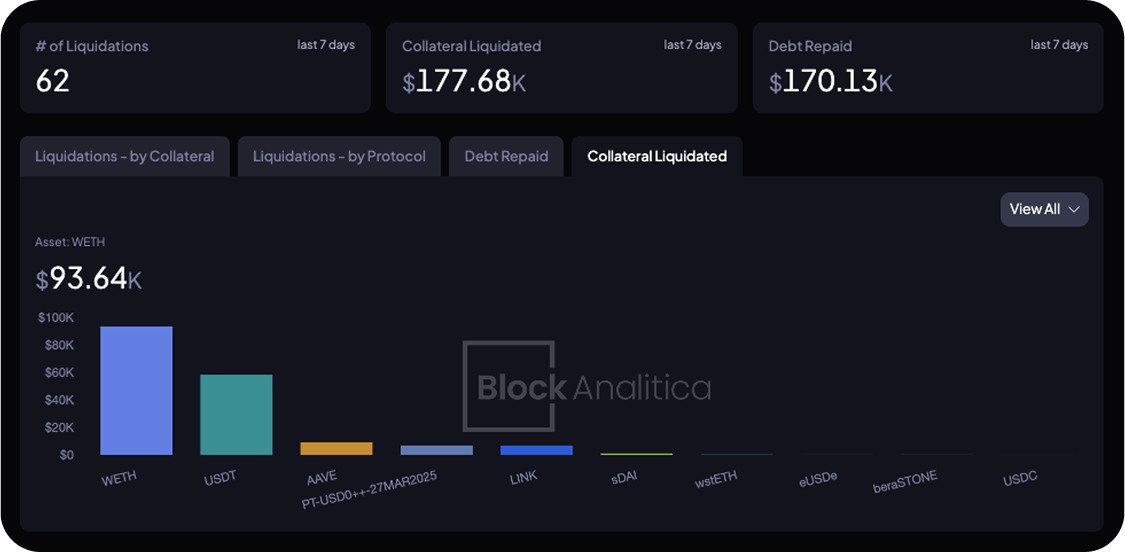

Custom Dashboards & Analytics

We build custom interfaces that surface protocol health, risk parameters, and governance-critical data.

Risk Monitoring & Advisory

We support teams with asset onboarding, parameter setting, and reacting to shifting market conditions.

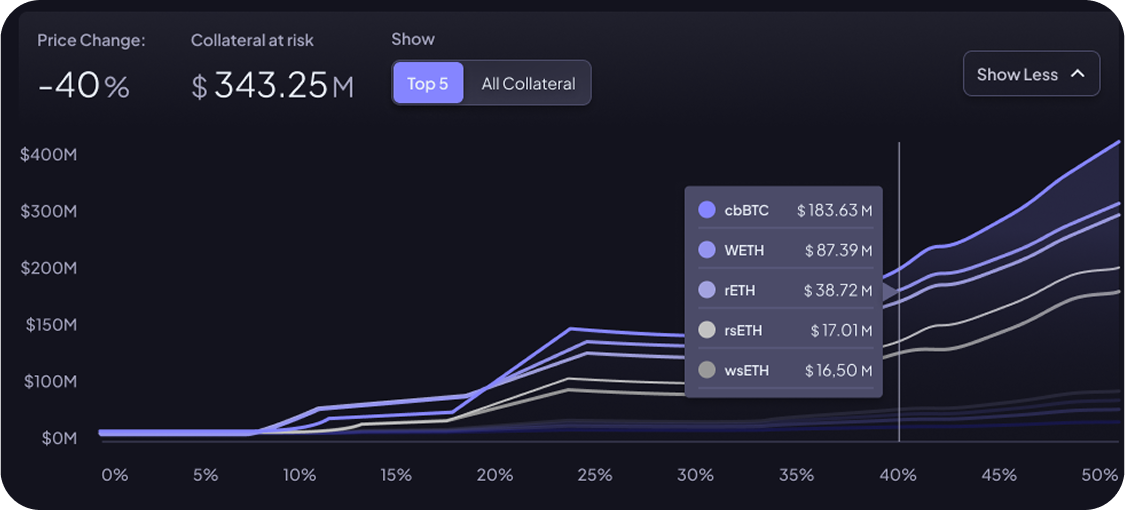

Modeling & Simulations

We design stress tests and tools that help protocols evaluate risk before it becomes a problem.

Stay Ahead of DeFi Risk Trends

Subscribe to our Substack for research, simulation insights, and protocol risk updates.